Employees Provident Fund- Contribution Rate The EPF MP Act 1952 was enacted by Parliament and came into force with effect from 4th March 1952. As mentioned earlier interest on EPF is calculated monthly.

EPF Interest Rates 2022 2023.

. So the EPF interest rate applicable per month is 86512 07083. The contributions made by employer and employee towards the EPF account is the same. Payment for unutilised annual or medical leave.

The following table shows the monthly contribution percentage. Thank you so much. But this rate is revised every year.

The Employees Provident Fund EPF announces that the minimum Employers share of EPF statutory contribution rate for employees above age 60 who are liable to contribute will be reduced to four 4 per cent per month while the Employees share of contribution rate will be zero per cent. Lets use this latest EPF rate for our example. As per latest EPF rules the employee contribution is 12 of Basic Pay Dearness Allowance.

For all your contributions the government guarantees a minimum paid dividend rate of 250 for Simpanan Konvensional. As mentioned earlier. Breakup of Contribution if Salary is above Rs.

Employees Deposit Link Insurance Scheme EDLIS. In general the contribution rate for the employee is fixed at 12. This privilege is only for the first three years.

In the union budget 2018-2019 new women employees can make an EPF contribution of 8 instead of 12. 22091997 onwards 10 Enhanced rate 12 a Establishment paying contribution 833 to 10 b Establishment paying contribution 10 to 12. EPF Contribution Rate 2022.

Employees Provident Fund EPF. The employer needs to pay both the employees and the employers share to the EPF. Per Annum Simpanan Shariah.

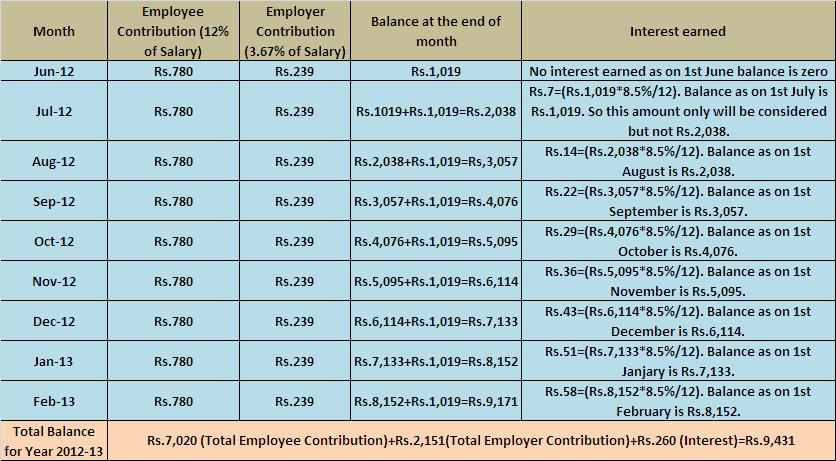

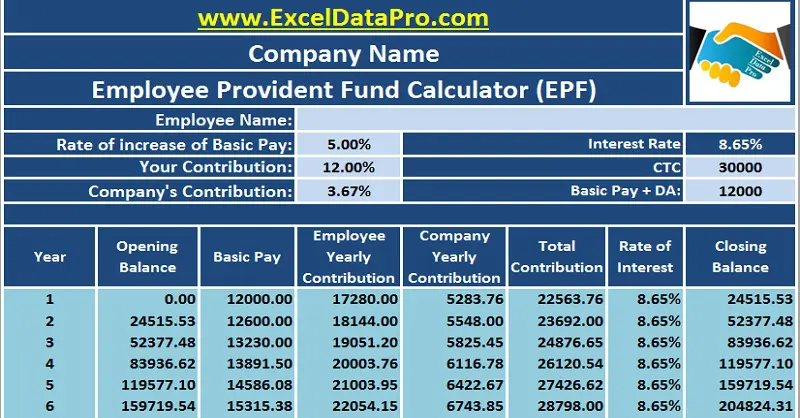

The EPF interest rate for FY 2018-2019 is 865. Earlier in the year of 2016-17 and 2018-19 the EPFO has given 865 rate of interest to the subscribers. Interest on the Employees Provident Fund is calculated on the contributions made by the employee as well as the employerContributions made by the employee and the employer equals 12 or 10 includes EPS and EDLI of hisher basic pay plus dearness allowance DA.

The minimum administrative charge is Rs. The EPF interest rate for FY 2018-2019 was 865. Therefore the Contribution Month is February 2018 and it has to be paid either before or on 15 February 2018.

The EPF interest rate for FY2020-21 was 850 unchanged from FY2019-20. EPF Dividend Rate. Contributions for a particular month will be eligible for dividend based on the.

She was a Director of. Enforcement Department and the Contribution Department. The Employees Provident Fund EPF informs that the reduction of the statutory contribution rate for employees share to eight 8 per cent which started for March 2016 wagesalary April contribution will end at the end of December 2017 wagesalary January 2018 contributionThe reduction of contribution rate was announced by the Government in 2016.

To better understand how EPF can help you take a look at how you and your employer contribute to it. Employers may deduct the employees share from their salary. Thus the interest rate is calculated by dividing the per annum rate with 12.

What is the dividend rate for EPF Self Contribution. Male employees must contribute 10 or 12 of their basic salary. Each contribution is to be rounded to nearest rupee.

The new minimum statutory rates will start. When the EPFO announces the interest rate for a fiscal year and the year closes the interest rate is computed for the month-by-month closing balance and then for the entire year. So the Total EPF contribution every month Rs 6000 Rs 1835 Rs 7835.

And it was 88 in 2015-16. 15000 amount will be Rs. Payments Liable For EPF Contribution Such As.

The EPF interest rate for the past 10 years is mentioned below. Prior to her retirement in December 2018 she was the Head of London Branch of CIMB Bank Berhad for 3 years from years 2015 to 2018. A series of legislative interventions were made in this direction including the Employees Provident Funds Miscellaneous Provisions Act 1952.

Employer contribution to EPF. The employer needs to pay both the employees and the employers share to the EPF. The employer contribution was cut to 10 during a recession in 1986.

Percentage of contribution Employees Provident Fund. Which are in effect from 1st June 2018. Presently the following three schemes are in operation.

KUALA LUMPUR 7 January 2019. You are so helpful. The current EPF interest rate for the FY 2021-22 is 810.

Though the interest rate is regulated on a yearly basis it is calculated on a monthly basis. Contribution to be paid on up to maximum wage ceiling of Rs. September 2 2020 at 711 pm.

Also as per Budget 2018 the rate of interest applicable on EPF is 865. The applicable interest rate on EPF contribution for the financial year 2021-22 is 810. A 10 rate is applicable in the case of establishments with less than 20 employees sick units or.

15000- even if PF is paid on higher wages. However the rate is fixed at 10 for the below-mentioned organizations. Division of EPF contribution.

The interest rate on EPF is reviewed on a yearly basis. The review of the EPF interest rate for a financial year is set at the end of that financial year most probably in February but may go up to April or May. So lets use this for the example.

Therefore the Contribution Month is February 2018 and it has to be paid either before or on 15 February 2018. Hope the above helps. August 4 2022 5.

EPF contribution is divided into two parts. If there is no contribution for a specific month the employer has to. As of now the EPF interest rate is 850 FY 2019-20.

EDLI contribution is paid even if member has crossed 58 years of age and pension contribution is not payable. With this 172 categories of industriesestablishments out of 177 categories notified were to pay Provident Fund contribution 10 wef. The EPF interest rate is reviewed every year by the EPFO Central Board of Trustees after consultation with the Ministry of Finance.

Fund contribution rate from 833 to 10. The Employees Provident Fund EPF established in 1951 is one of the oldest and largest retirement funds in the world. Employee contribution to EPF.

Employees Contribution towards EPF. The EPF interest rate for the fiscal year 2022-23 is 810. Kumpulan Wang Simpanan Pekerja KWSP is a federal statutory body under the purview of the Ministry of FinanceIt manages the compulsory savings plan and retirement planning for private sector workers in MalaysiaMembership of the EPF is mandatory for Malaysian citizens employed in the private sector and voluntary for non.

Employee Pension Scheme EPS 833. The rate of contribution was progressively increased to 25 for both employers and employees in 1985. EPF Contribution Rate FY 2021-22.

Employers may deduct the employees share from their salary. For those who would like to know more about their contribution rate you can view the rates below up to the age of 60. Because theres a matching incentive of 15 up to RM250 per year for EPF i-Saraan contribution from the year 2018 until the year 2022.

Employees Provident Fund Interest Rate Calculation 2022. The government has decided to retain the EPF interest rate of 8 for the financial year 2021-22. Written by Rajeev Kumar Updated.

Contribution Rate for Employees Salary up to Rs15000. As of 2018 the employers CPF contribution is 17 for those up to age of 55 and decreases to 75 for those 65 and above. For each employee getting wages above Rs.

Budget 2020 New Tax Slabs Tax On Dividend Employer Contribution To Nps Epf And Some Mess For Nris Personal Finance Plan

Epf Calculator Employees Provident Fund

Difference Between Epf And Ppf Income Investing Investing Basic

Basics And Contribution Rate Of Epf Eps Edli Calculation

How Does A Lower Epf Contribution Impact Your Retirement Savings

How Epf Employees Provident Fund Interest Is Calculated

Share And Stock Market Tips Epfo Signs Pact With Banks For Epf Contribution An Savings Account Financial News Changing Jobs

What Is The Epf Contribution Rate Table Wisdom Jobs India

Summary Of Case Study On Employee Provident Fund Of Malaysia

20 Kwsp 7 Contribution Rate Png Kwspblogs

Epf Interest Rate 2021 22 How To Calculate Interest On Epf

What Is Epf Deduction Percentage Quora

Download Employee Provident Fund Calculator Excel Template Exceldatapro

Epf Contribution Rates 1952 2009 Download Table

Epf Interest Rate From 1952 And Epfo